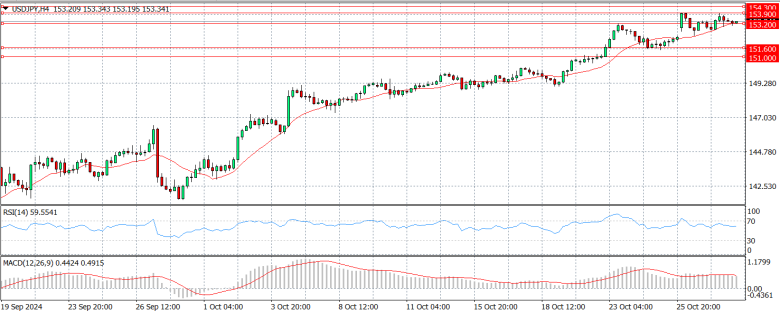

EUR/USD

Prediction: Decrease

Fundamental Analysis:

The EUR/USD pair has risen to around 1.0820 in the early Asian session on Wednesday, though its upside potential is limited due to uncertainty from the U.S. presidential election and upcoming economic data.

On Tuesday, the pair struggled to extend Monday's rebound, fluctuating around 1.0800 after falling to about 1.0770 earlier. It remains below the 200-day Simple Moving Average at 1.0868, suggesting further declines could be possible.

The U.S. Dollar's rally is losing momentum, even as the Dollar Index hits new highs above 104.60. Market participants are anticipating a 25-basis-point rate cut by the Fed next month, but some officials express doubts.

In Europe, the ECB has cut rates and remains cautious, emphasizing the need for careful monitoring of economic data. Upcoming releases, including the U.S. Q3 GDP Growth Rate and Germany's inflation figures, are likely to influence market sentiment.

Technical Analysis:

Further declines could bring EUR/USD down to its October low of 1.0760, opening the door to test the round number 1.0700 and the June low of 1.0666.

On the upside, the first resistance is at the 200-day SMA of 1.0868, followed by the 100-day and 55-day SMAs at 1.0933 and 1.1023, respectively. Next, we have the 2024 peak of 1.1214 and the 2023 high of 1.1275.

The outlook remains negative while EUR/USD is below the 200-day SMA. The four-hour chart shows a range-bound trend, with initial support at 1.0760 and resistance at 1.0839. The relative strength index is nearing 50.

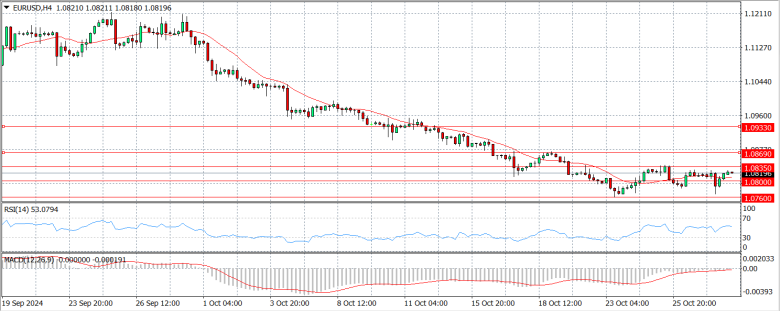

XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices reached a new record high during the Asian session on Wednesday, driven by ongoing safe-haven demand due to uncertainty around the U.S. presidential election and tensions in the Middle East.

Additionally, a slight pullback in the U.S. Dollar from a three-month low and falling U.S. bond yields provided support for XAU/USD.

Spot Gold surpassed the $2,770 mark as investors sought safety ahead of key economic data and the upcoming elections. The market gained momentum after the release of U.S. data, including a rise in the Conference Board Consumer Confidence Index to 108.7 in October, up from 99.2 in September.

However, an employment report showed job openings at 7.44 million, indicating a cooling labor market, which the Federal Reserve may view positively due to easing wage pressures.

Investors remain cautious, awaiting the preliminary Q3 Gross Domestic Product estimate and Friday’s Nonfarm Payrolls report. The U.S. will also release the Personal Consumption Expenditure Price Index, a key inflation measure for the Fed, which could influence its monetary policy decision scheduled for November 7, just after the presidential election.

Technical Analysis:

XAU/USD has pulled back from its recent high but is holding most of its intraday gains, trading around $2,766. Daily chart indicators suggest potential for further upward movement.

The 20 Simple Moving Average is rising and currently sits around $2,685, while longer moving averages are also gaining bullish momentum, positioned over $300 below the current price.

In the 4-hour chart, indicators support a bullish trend, moving upwards within positive territory and approaching overbought levels but still with room to rise. The 20 SMA is providing dynamic support at approximately $2,740.60, while the 100 and 200 SMAs remain strongly bullish, positioned well below.

GBP/USD

Prediction: Decrease

Fundamental Analysis:

The GBP/USD pair is softening around 1.3010, despite a consolidation of the U.S. Dollar during the early European session on Wednesday. Investors are looking forward to the UK’s Autumn Budget, the U.S. October ADP Employment Change, and the advanced Q3 Gross Domestic Product, all scheduled for later today.

Earlier this week, GBP/USD fluctuated in a narrow range before closing nearly unchanged, remaining in a consolidation phase above 1.2950. While the U.S. Dollar showed some strength on Monday, GBP/USD managed to limit its losses due to a slight improvement in risk sentiment.

Later today, the JOLTS Job Openings data is expected to drop to 7.99 million from 8.04 million in August. A significant surprise could impact the Dollar, causing fluctuations in GBP/USD.

Investors may remain cautious ahead of key announcements this week. British Prime Minister Keir Starmer emphasized the need for tough decisions in the budget, without guaranteeing "no tax rises" in the future, stressing the importance of investing in the country’s future.

Technical Analysis:

GBP/USD is trading within a descending regression channel that began in late September, but the Relative Strength Index on the 4-hour chart is moving sideways around 50, indicating a lack of clear momentum.

The 100-day Simple Moving Average acts as a key pivot at 1.2970. If the pair closes above this level and confirms it as support, it could attract technical buyers, pushing prices higher toward 1.3010 and 1.3060.

On the downside, initial support is found at 1.2900-1.2890, followed by 1.2800.

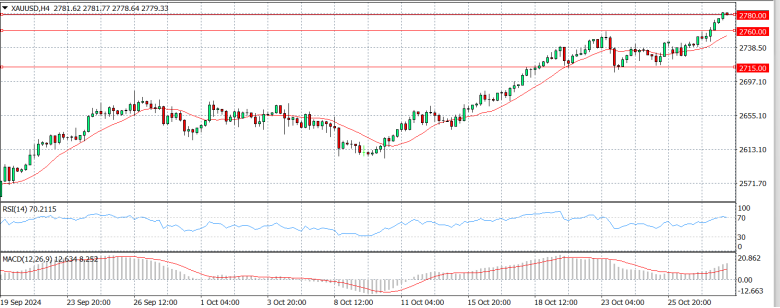

USD/JPY

Prediction: Increase

Fundamental Analysis:

USD/JPY is consolidating its recent gains at a three-month high as traders remain cautious ahead of this week’s critical BoJ policy decision and key U.S. economic releases. Doubts about the Bank of Japan's ability to raise interest rates further, along with a positive market sentiment, may continue to undermine the safe-haven Yen.

The pair draws support from the strong performance of the U.S. economy, especially as other major economies experience slowdowns. This reinforces the expectation that any easing by the Fed will be gradual, supporting U.S. Treasury yields and the Dollar.

In Japan, uncertainty following Sunday’s elections is also impacting the Yen. The Bank of Japan is expected to keep rates on hold until the political landscape stabilizes.

Today, U.S. consumer confidence is anticipated to improve for October, while JOLTS Job Openings are expected to decline modestly but remain healthy.

Technical Analysis:

From a technical standpoint, the bullish trend remains, but the RSI indicates a bearish divergence, suggesting a possible correction ahead. Resistance levels are at 153.90 and 155.10, with support at 152.50 and 151.60.

Disclaimer

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.cal U.S. jobs report scheduled for the end of this week.